Get the free hsbc kyc update form

Show details

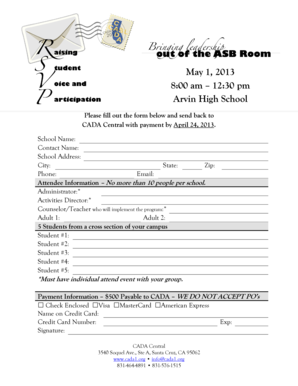

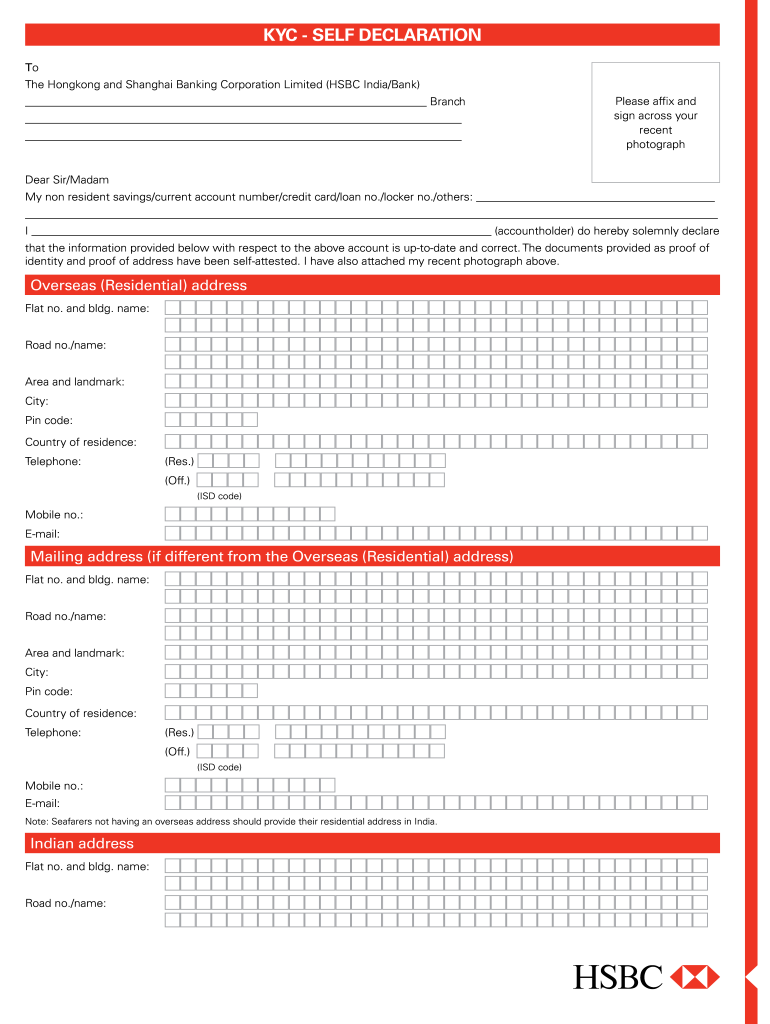

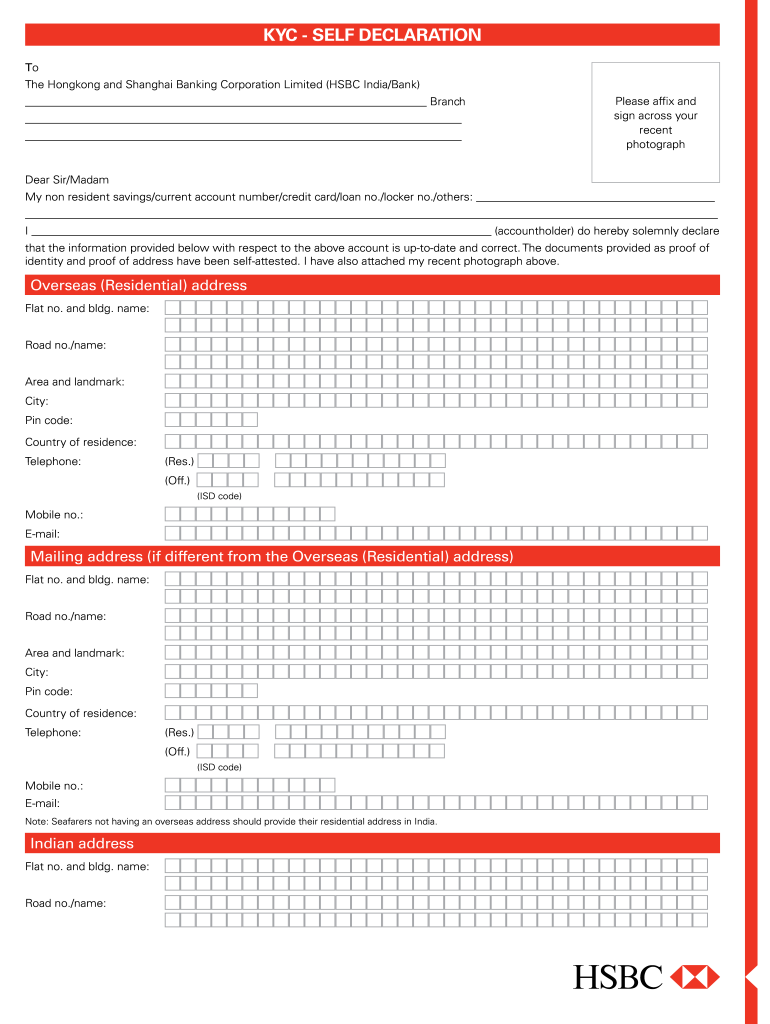

KYC SELF DECLARATION To Thong Kong and Shanghai Banking Corporation Limited (HSBC India/Bank) Branch Please affix and sign across your recent photograph Dear Sir/Madam My non-resident savings/current

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsbc credit card kyc online form

Edit your hsbc kyc form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsbc kyc form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hsbc kyc update hsbc co in online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hsbc credit card kyc form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsbc kyc form download

How to fill out HSBC KYC form:

01

Start by gathering all the necessary documents such as identification proof, address proof, and income proof.

02

Fill in your personal details accurately in the designated sections of the form, including your full name, date of birth, and contact information.

03

Provide your employment details, including your occupation, employer's name, and address.

04

Fill in your financial information, such as your annual income, net worth, and source of income.

05

Complete the section related to your banking history, including any previous accounts you hold or have held with HSBC or other financial institutions.

06

Sign and date the form and review all the information provided to ensure its accuracy.

07

Submit the completed form along with the supporting documents to the designated HSBC branch or through the prescribed online channel.

Who needs HSBC KYC form:

01

Individuals who are opening a new account with HSBC, irrespective of the account type, need to submit the KYC form.

02

Existing HSBC customers who are required to update their KYC details as per regulatory guidelines.

03

Customers who intend to perform high-value transactions or engage in certain financial activities that require enhanced due diligence, as determined by HSBC or regulatory authorities.

Fill

hsbc safeguard kyc form

: Try Risk Free

People Also Ask about hsbc india kyc form

What documents required for HSBC bank?

Documents required for Hsbc Bank Account Account Account Savings Account Two Passport Size Coloured Recent Photographs. Copy of PAN Card/ Form 60 (with reasons of not having PAN Card). KYC (Know Your Customer) Documents : Proof of Identity & Proof of Address.

What is HSBC KYC form?

This form aims to collect information with regards to your identity, financial standing, business activities and other relevant details as part of our Customer Due Diligence requirements.

How can I open a bank account in HSBC?

Steps To Open an HSBC Account Determine Which Bank Account You Want To Open. The HSBC account you want to open depends on your current banking needs. Gather Your Personal Information. Apply Online or in Person.

What is the KYC process for credit card?

KYC process includes ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification. Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud. KYC compliance responsibility rests with the banks.

What documents required for opening bank account in HSBC?

Below mentioned are the documents that the customer would require to open a savings account in HSBC. Proof of identity. Address proof. Passport size photograph. Duly filled application form.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hsbc kyc update for eSignature?

When your how to update kyc in hsbc online is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete hsbc kyc online online?

Filling out and eSigning hsbc video kyc is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in hsbc kyc without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing hsbc video kyc link and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is hsbc kyc form?

The HSBC KYC (Know Your Customer) form is a document used by HSBC to collect necessary information from customers to verify their identity and assess potential risks related to money laundering and fraud.

Who is required to file hsbc kyc form?

All new customers and existing customers in certain situations, such as when there are changes to account information or when requested by HSBC, are required to file the HSBC KYC form.

How to fill out hsbc kyc form?

To fill out the HSBC KYC form, customers should provide accurate personal information, including their full name, address, nationality, occupation, and identification details. It's important to review the form for completeness and correctness before submission.

What is the purpose of hsbc kyc form?

The purpose of the HSBC KYC form is to comply with regulatory requirements, prevent financial crimes, ensure the bank knows its customers, and protect both the financial institution and its clients.

What information must be reported on hsbc kyc form?

The information that must be reported on the HSBC KYC form typically includes personal identification details such as name, date of birth, address, occupation, and identification numbers (like passport or national ID numbers).

Fill out your hsbc kyc update form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsbc Bank Kyc Form is not the form you're looking for?Search for another form here.

Keywords relevant to hsbc kyc online submission

Related to kyc hsbc

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.